5 alternatives to Coinzilla to promote your crypto project. The bitter truth about Web3 growth channels

A review of 5 popular crypto-traffic sources with all their good and bad.

Being the largest web2 crypto ad network and serving over a billion impressions monthly, Coinzilla is an easy choice for crypto-advertisers to run their campaigns. However, size comes at a cost, and it’s easy to understand by looking at Coinzilla’s publishers. They consist mostly of more and less popular crypto-media, info-products and coin price trackers like Coingecko, which are rich in impressions but poor in traffic quality.

What you as an advertiser should understand, is that all of them are web2-websites on crypto-related topics. None of them have a wallet connection. And their audience can reach up to 100M monthly hits, while the actual number of active wallets onchain in Q1’2023 is around 2M (as per DappRadar data).

Meaning, without specific targeting (which Coinzilla do not provide) 98% of the advertising budget will go directly to waste due to the impressions used by users that do not even have a wallet and do not use crypto assets.

This leaves advertisers on the lookout for better alternatives, and today we will cover the top-5 of them to make sure that your ads will get seen by the highest-value audience. Without further ado:

1. Other web2 ad networks

Coinzilla is not the only Web2 ad network in the space, it has direct competitors such as Bitmedia, Cointraffic, A-Ads, and a few smaller ones, that operate on exactly the same model, and often integrate with the same publishers.

The good:

Such solution have their benefits: they have a huge volume of traffic that you won’t be able to exhaust, and can sell it quite cheap. Also, they seem to have no limitations to work with token offerings, and gambling ads.

The bad:

But they also inherit all the drawbacks of web2-native traffic, with its low quality, minimal engagement and bottom-low CTRs, and little relevancy for Web3 projects. As a result, they got used mostly for casinos and token pumps.

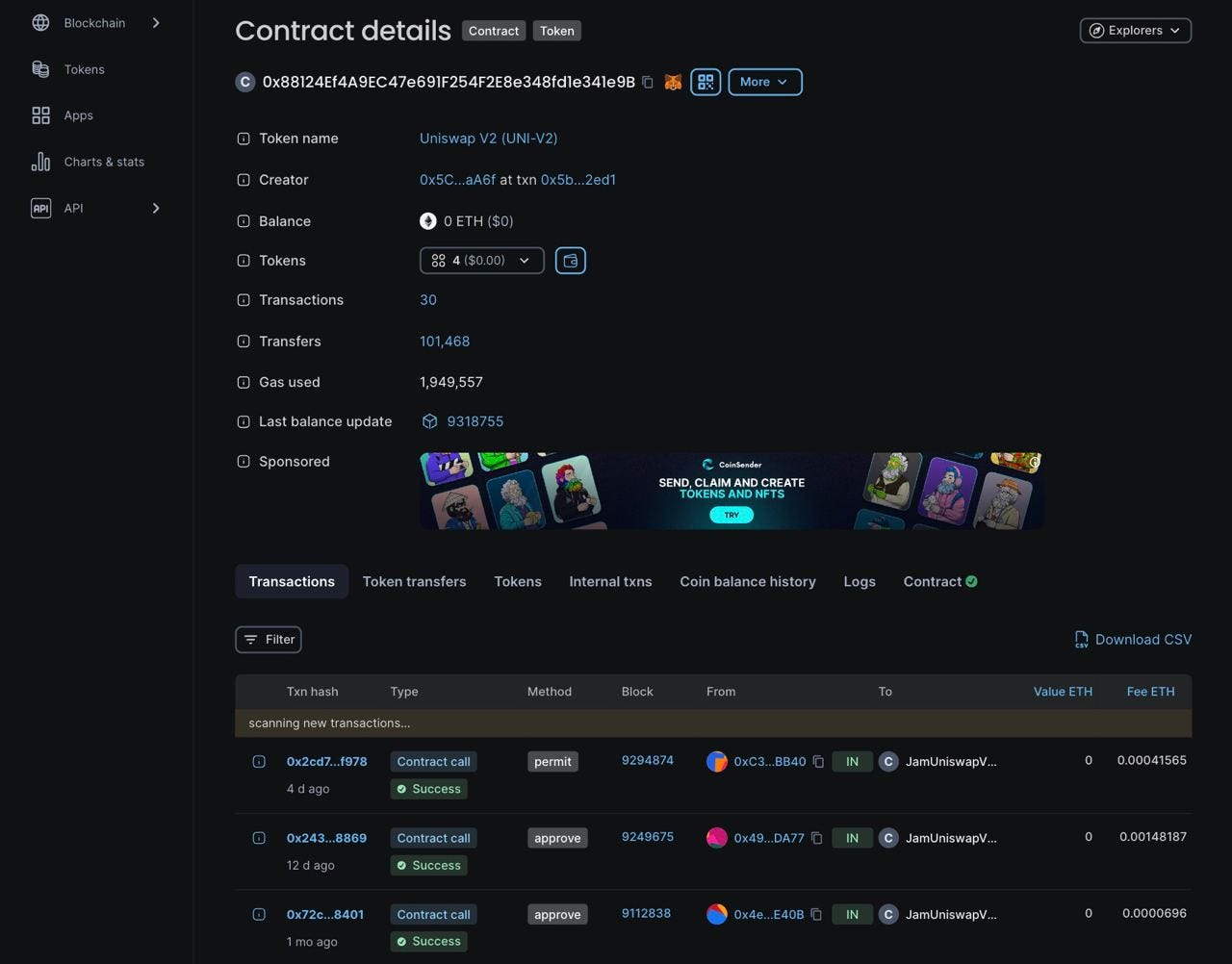

2. Web3-native ads

Web3-native ad networks adopt a different approach and go for quality over quantity. They predominantly place advertising on dApps — decentralized applications that work on top of a blockchain and require users to connect their wallets. Such may include DeFi protocols, NFT analytics tools, marketplaces, DEXes, Web3 games, blockchain explorers, minting tools, and more.

The audience of such dApps is small (remember 2M we mentioned earlier) but it consists of actual real crypto-users active onchain, who already have wallets and crypto-assets, and make the ideal persona with the highest LTV for a new crypto project.

The ads are not common on dApps, so it’s rather a novel approach and Slise.xyz is a good example of a successful pioneer in the space. Doesn’t come as a surprise that their advertisers in turn are not casinos, but established Web3 brands such as Ledger, Quicknode, Zerion, Binance, and others.

The good:

Highest-quality traffic of crypto-natives that is impossible to find otherwise, much higher CTR, and the possibility to do targeting based on the wallet history and onchain assets. High LTV of the acquired users for the project in comparison to users who don’t have crypto assets and have to be onboarded.

The bad:

Rather limited reach due to the small size of the whole Web3 space, and a higher price of CPM than in Web2 sources, which could go even higher for targeted segments. Although, it should be compared, and sometimes the price can be on par with traditional Web2 traffic.

3. Twitter ads

Unlike Google and Meta, Twitter has more forgiving rules for crypto-projects due to which it attracts advertisers banned in the first two. Without a doubt, Twitter is also the most popular communication platform for crypto-users and crypto-projects, which helps with the reach. On the other hand, Twitter is still a Web2 platform that does not have access to onchain data and can only help to target users based on their approximate interests and whom they follow.

The good:

Good chance to find real crypto users with precise targeting, but expect that CPM in that case will be comparable to Web3 ads. Best place to promote your Twitter account and build a social presence. Less so acquire paying customers.

The bad:

Hard to segment real crypto-users from all the other users of twitter and especially bots. More often than not twitter accounts do not translate into active wallets and exist purely for social activity and rewards. High amount of spam and scam that lower user-engagement with paid ads.

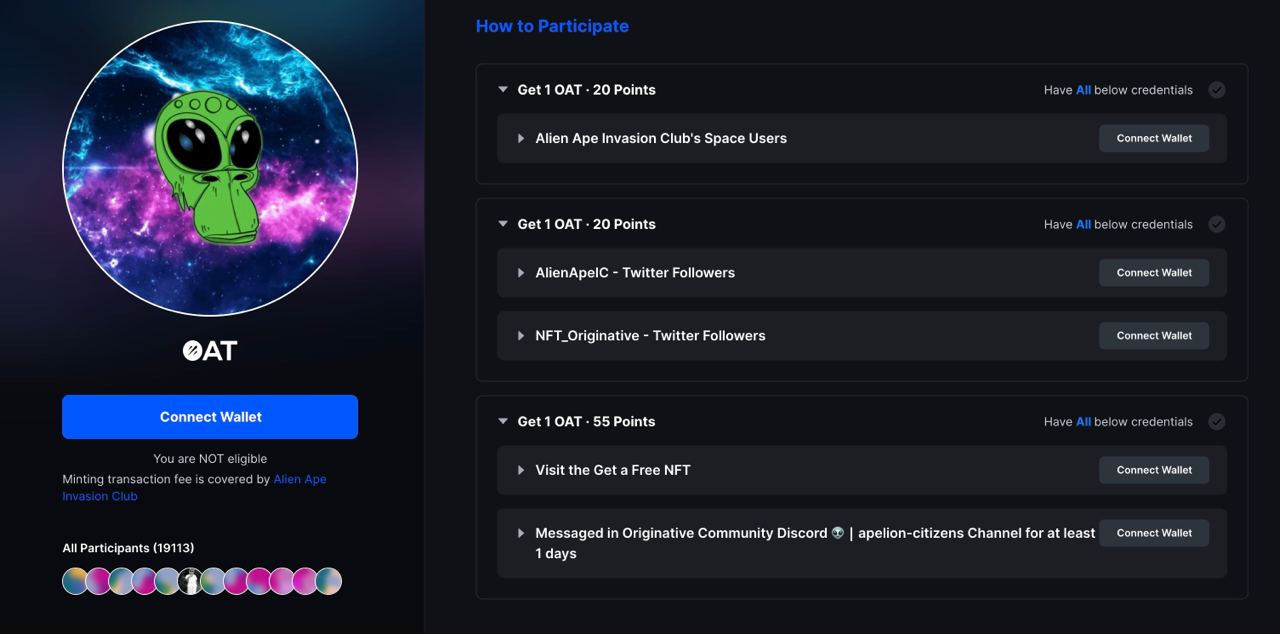

4. Rewarded-quest platforms

An easy way to hike your number in the crypto world is to use quest platforms. The nature of such platforms is in incentivizing users to complete a set of tasks (such as following twitter-page, joining a discord channel, registering an account, depositing X amount in a protocol), in exchange for a reward — immediate (usually monetary in form of tokens) or delayed (usually in form of expectations of airdrops).

The popular players in this category include Galxe, QuestN, Layer3, Zealy, and others.

The number of users on such platforms is immense, but the dark side of it is that most of them are airdrop-hunters and hundreds of their fake accounts that artificially 1000x the real number. The second part of the userbase is users from 3rd-world countries that want to earn small rewards from a quest because it means a significant income for them. Such users by definition do not translate into a paying audience well. I’m sorry to break it to you, but investors, traders, developers, and whales do not sit and click on quests all day.

The good:

Very cheap cost of acquisition (CPA), and a quick way to bump up the vanity metrics for social proof or other needs. Ability to grow your social channels as well as your product.

The bad:

Close to zero retention and almost no difference from the bot traffic. Be assured, even that small fraction of real users that will come from quests will come for a reward, not for the product. Such users do not build a strong userbase and do not improve important product metrics. Easy come—easy go.

5. Doing an airdrop

Airdrops is by far the most mysterious user acquisition channel in crypto. The process implies spending money not on the traffic, but on the rewards to your existing users and expecting that a wider audience will get to know about it through word-of-mouth and will want to become your users to not miss another airdrop.

There are a lot of fundamental problems with the model, but what’s the worst, is that it actually works. For a crypto audience mostly driven by financial incentives and a chance to get rich, such an opportunity sounds really sexy, and the FOMO pushes even adequate users to simulate activity on a protocol to get the chance to receive the next drop.

To be more realistic, airdropping means giving away money, and not cents, as you would pay for an ad impression, but hundreds of dollars to a single user. How this works out in the CAC model nobody really counts, but hey, the numbers go brrr, just as with quests, making middle-level marketers looks genius for growing the KPI.

The good:

It’s an efficient way to grow your short-term user base via social FOMO and by “buying” users. Huge benefit: you can do it with your token and not real money, which is easier to print.

The bad:

Users that come for airdrop come for a reward, not your product, and they will leave even faster than they came once they are able to cash out that reward.

Conclusions

We are sorry to give you a red pill rather than a blue pill that would magically solve your problems, but awareness of the problem is the first step to solving it. So at least we hope you will not fall for common mistakes and will spend your ad budget wisely, tracking each step in the funnel, optimizing your approach and finding the best source that will work for your case.

P.S. And if you just need numbers without quality—simply pay for the bots, it will save you time and money.

Subscribe to join the club of Web3 Marketing realists, and share with friends to promote your crypto project.

You can reply and tag me on Twitter—the only platform I will engage at.